Blog

The Importance of Cash Flow before Profits

We have all heard the age-old saying: “Bigger is Not Always Better.” Well, the same is true when businesses aim to expand their market presence and profitability through acquisitions and taking on ridiculous debt.

Then there are businesses that focus not on profits, but aim to improve cash flow to improve financial leverage, and remain flexible and opportunistic to the market.

The book, The Outsiders, highlights the stories of unconventional CEOs who aimed to focus on cash flow over profits. Author William N. Thorndike, Jr. describes the obsession for maximum earnings per share (EPS), as “the holy grail for most public companies, inconsistent with the pursuit of scale” (p. 90).

John Malone is a prime example of a CEO who employed unconventional wisdom to rise above his competition. As the cable television industry was booming in the early 1970s, Malone leapt at the opportunity to run Tele-Communications Inc. (TCI), a major cable company during that time. Under previous management, TCI was on the verge of bankruptcy having aggressively sought growth through picking up unsustainable debt. Malone took control by first scaling back the company’s operating expenses. He did not create a headquarters with a lavish presence in Midtown Manhattan, instead resorting the company’s operations to low-scale offices with used desks and equipment. When Malone traveled with his executive team, they would room together at motels to keep costs low. Malone established the company’s strict budgeting process, and delegated responsibility to managers to meet cash flow goals, not sales or profit goals. This quickly led to a culture of frugality, and TCI soon had the highest margins in the industry.

Focused on maximizing “output” while minimizing “noise” Malone sought to create leverage through higher cash flow than its competitors, and consistently higher customer subscribers. He understood that creating a competitive advantage in the cable industry in the midst of intense competition could only be realized through maximizing financial leverage beginning with cash flow.

Malone famously stated at the time: “The key to future profitability and success in the cable business will be the ability to control programming costs through the leverage of size” (p. 89). When he spoke of size, Malone was not implying the company’s presence through expensive acquisitions, but by subscriber count. Since TCI, like its competitors in the cable TV industry, paid a hefty 40 percent fee to programmers like HBO, ESPN, etc., TCI focused on using its financial leverage to negotiate lower programming costs per subscriber.

Soon after stabilizing TCI’s balance sheet and realizing significant cash flow through a net reduction in operating expenses, Malone extended discounts on programming to acquire new subscribers. As the company grew in size (through subscriber count), Malone was able to negotiate lower fees to programmers, thereby achieving greater returns. Malone’s unconventional business model was simplified to:

- Use financial leverage to acquire subscribers

- Negotiate lower programming costs

- Realize profits

- Increase cash flow … enabling more financial leverage

And the cycle starts with using financial leverage to improve systems, and acquire more subscribers (p. 90).

From Malone’s unconventional approach, we see the powerful benefits of maximizing a business’s cash flow before aiming for profits. This simple formula allowed TCI to command industry-wide presence, scalability, and sustainable competitive advantage.

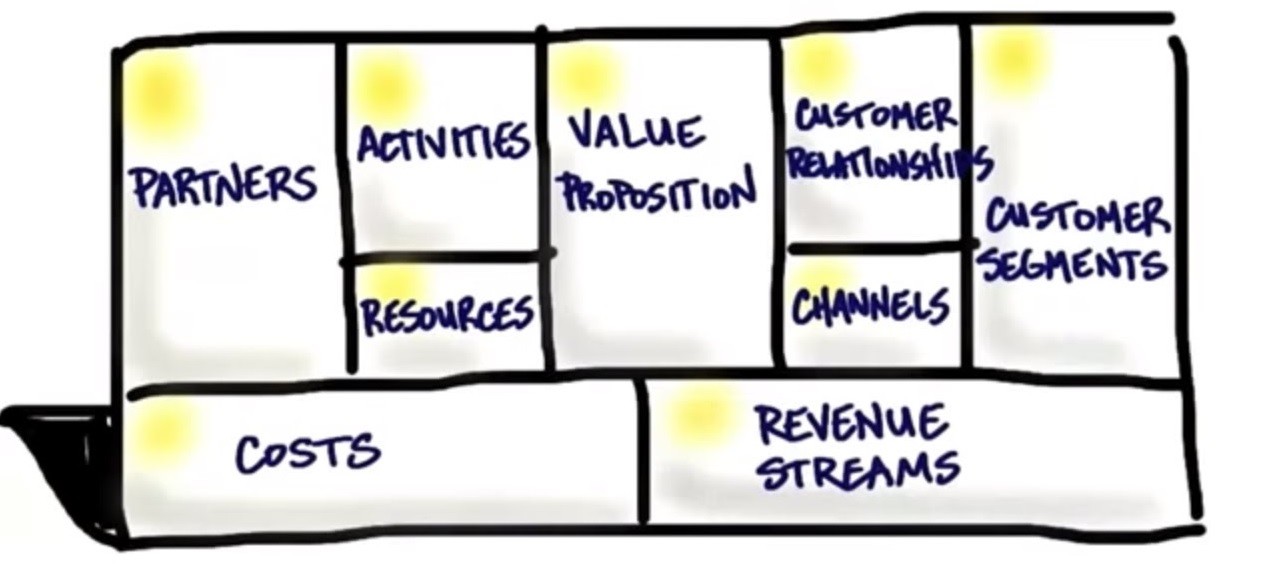

Businesses can take a lesson to emphasize the importance of cash flow as the key driver to establishing financial leverage, engaging mutually beneficial partnerships, and employing a flexible business model to address the market quickly before the competitors have a chance to review their budgets.

Reference:

Thorndike Jr., William N. (2012). The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success. Harvard Business Review Press, Boston, MA.

Leave a Reply