Blog

GRC: The Key Driver to Sustaining Data Privacy

Many organizations today are not entirely prepared to address the challenges brought on by the need for continued compliance, as evidenced by the number of corporate data privacy disasters. It is clear that data privacy requires a special emphasis beyond implementing costly solutions to improve the organization’s security posture.

Management can correct this by establishing a consistent and transparent Governance, Risk, and Compliance (GRC) model.

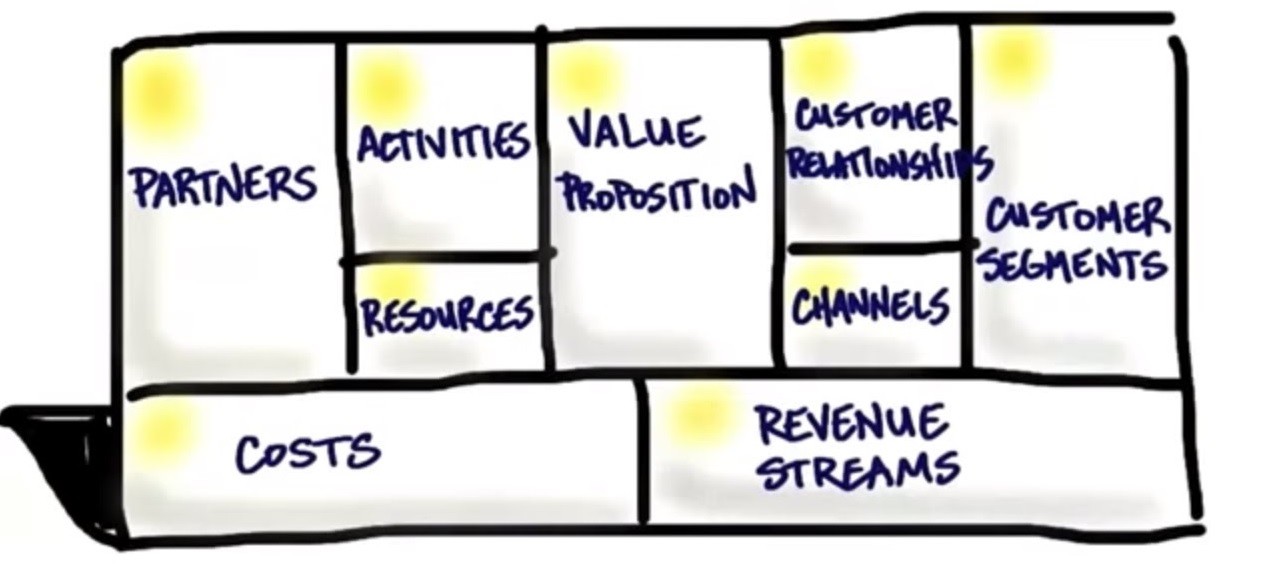

The following key factors characterize a successful implementation of enterprise-wide GRC:

Organizational and Regulatory Compliance

Regulatory compliance and data security form the pillars of a successful GRC model, yet have become increasingly difficult to maintain in today’s constantly evolving technological age. It is not uncommon to read headlines that spotlight organizations’ data protection readiness and privacy compliance when big name retailers such as Target, Home Depot and Sony experience major data breaches. The root issue in most of these cases is organizations’ failure to prioritize and execute a consistent compliance framework that prioritizes its customers’ need for data privacy.

Instead, organizations too often develop an ad hoc approach to comply with both their internal and regulatory requirements. As these approaches grow over time with the onset of technological and regulatory changes to the environment, they become overly complex and confusing. When risks such as data breaches materialize, organizations spend millions of dollars on legal fees and other ramifications, including loss of business and customer trust.

To remedy these issues, management must prioritize the protection of its customers’ information. When organizations make a strong commitment to prioritize customer data privacy, they must also assess associated risks through a continuous risk management program.

Risk Management Program

In the GRC context, proper risk management begins with classifying risks to the organization’s information assets, including customer data. From here, management establishes the relevant processes and controls to mitigate the risks, following by a continuous monitoring to detect new or residual vulnerabilities to introduce new safeguards. As organizational needs evolve, the technologies, people and processes that support the business also need to adapt and innovate. While other GRC strategies and its efforts were largely reacting, today’s most successful GRC strategies are moving from industry point solutions that meet specific regulations to broader efforts that cross business units. The GRC model must be specifically designed to help organizations manage regulatory compliance, and integrate information while transitioning to “next-generation” technology.

Management’s Internal Controls

When developing long-term GRC capabilities, organizations must identify controls that mitigate risks while preventing unneeded overhead and impact to operations. Regulatory compliance mandates such as the Sarbanes Oxley Act requires segregation of duties (SOD) to prevent error and fraud. With limited resources at hand, organizations often find themselves overwhelmed by the demand these new regulations place on them.

Management’s internal controls must therefore specifically target the risks to meeting data privacy compliance with an integrated view of the business’s strategy and operations to account for agility to mitigate the threat of evolving challenges.

In closing, a successful GRC model promotes transparency and cooperation between entities such as legal, compliance, risk, and quality control, with the collective goal of meeting the organization’s changing internal and regulatory compliance needs.

When organizations implement GRC, it helps them to achieve better compliance measures through incorporating continuous risk management and management’s internal controls. This ultimately results in a consistent and transparent model to enabling greater awareness throughout the enterprise, and successfully tackle new threats.

Leave a Reply